Monday, July 29, 2019

Wednesday, July 24, 2019

Should I Refinance My Home?

With the recent lower interest rates, many homeowners are wondering if they should refinance. To decide if refinancing is the best option for your family, start by asking yourself these questions:

Why do you want to refinance?

There are many reasons to refinance, but here are three of the most common ones:

- Lower your interest rate and payment – This is the most popular reason. If you have a 5% interest rate or higher, it might be worth seeing if you can take advantage of the current lower interest rates, hovering below 4%, to reduce your monthly payment and overall cost of the loan.

- Shorten the term of your loan – If you have a 30-year loan, it may be advantageous to change it to a 15 or 20-year loan to pay off your mortgage sooner.

- Cash-out refinance – With home prices increasing, you might have enough equity to cash out and invest in something else, like your children’s education, a vacation home, or a new business.

Once you know why you might want to refinance, ask yourself the next question:

How much is it going to cost?

There are fees and closing costs involved in refinancing, and Lenders Network explains:

“If you were to refinance that loan into a new loan, total closing costs will run between 2%-4% of the loan amount.”

They also explain that there are options for no-cost refinance loans, but be on the lookout:

“A no-cost refinance loan is when the lender pays the closing costs for the borrower. However, you should be aware that the lender makes up this money from other aspects of the mortgage. Usually pay charging a slightly higher interest rate so they can make the money back.”

If you’re comfortable with the costs of refinancing, then ask yourself one more question:

Is it worth it?

To answer this one, we’ll use an example. Let’s assume you have a $200,000 home loan. A 4% refinance cost will be $8,000. To break even, you would need to continue owning your home for 3 years or more.

Now that you know how the math shakes out, think about how much longer you’d like to own your current home. If you plan to stay for more than 3 years, then maybe it is advantageous for you to refinance.

If, however, your current home does not fulfill your present needs, you might want to consider using your potential refinance costs for a down payment on a new move-up home. You will still get a lower interest rate than the one you have on your current house, and with the equity you’ve already built, you can finally purchase the home of your dreams.

Bottom Line

There are many opportunities for growth in the current real estate market. To find out what’s right for your family, let’s get together to help you understand your options and guide you toward the best decision.

Monday, July 22, 2019

Friday, July 19, 2019

Need to Soundproof Your Home?

8 Ways to Soundproof Your Home

Your home is your sanctuary; however, if outside noises prevent you from getting the rest and relaxation you need, your health and productivity could suffer. Soundproofing your home doesn't need to be a huge, expensive hassle. There are some easy ways to dampen the sound of your neighbor's dog barking or reduce the sound of trucks roaring down the freeway.

- Fill cracks and holes

- Replace your doors

- Install window inserts

- Get high-quality storm windows

- Hang heavy draperies

- Fill your rooms with furnishings, carpets, wall hangings

- Don't overlook the roof - chimney caps

- Grow a Green Thumb

Thursday, July 18, 2019

2019 Street of Dreams at Stafford Meadows

Visit the Street of Dreams and be inspired by the

new trends in home design

July 27th - August 25th, 2019

10am - 9pm Daily

August 6th is Celebrate Veterans Day -

Free admission to current and former military members and family

Wednesday, July 17, 2019

What Buyers Don't Want

Last week I posted 'What Buyers Want' in a home when they are searching for their next home. The National Association of Homebuilders report indicated the top desired features being a laundry room, updated windows and a patio.

The same NAHB publication also reported what features recent and prospective buyers don't want to find in their next home. Two-thirds of home buyers expressed that they do not want an elevator in their home, according to NAHB’s recently released report, What Do Home Buyers Really Want, 2019 edition.

This finding comes from a question in the survey asking recent and prospective home buyers (people who bought homes in the previous three years or are planning to do so in the next three years) to rate home and community features on a four-tier scale of ‘do not want’, ‘indifferent’, ‘desirable’, and ‘essential/must have’. The selection of ‘do not want’ means that home buyers are unlikely to purchase a home with that particular feature. The other features that are most unwanted by home buyers include:

It comes with little surprise that elevators make this list as they are not a common feature installed in single-family homes, the housing structure that a majority of home buyers want (77 percent). They are much more common in multifamily structures, a structure type that only 4 percent of home buyers expressed a desire to live in.

Three other features are rejected by at least half of home buyers: a wine cellar (57 percent), a plant-covered roof (50 percent), and a daycare center nearby (50 percent). Besides a day care center, two other community features make the top ten most unwanted list: a golf course community (47 percent) and a high-density development (46 percent) (in this context meaning smaller lots and attached/multifamily buildings).

Two materials also make the list: cork flooring is rejected by 47 percent of buyers and laminate kitchen countertops by 46 percent. Rounding out the top ten most unwanted features are a pet washing station (49 percent), dual toilets in master bath (48 percent), and a two-story family room (47 percent).

Monday, July 15, 2019

Saturday, July 13, 2019

June 2019 Real Estate Market Statistics

(For

the past few years, I've used my photographs for the headline photos on

the monthly market updates, using local area scenes in 2017 and roof

tops of homes sold in 2018. This year I'm featuring public art that can

be found in our local communities.)

The following is the latest Real Estate Market Statistics for June 2019.

Click here for the full report

The following is the latest Real Estate Market Statistics for June 2019.

Click here for the full report

- Sales: 2,756 in June 2019 vs 2,946 last June: -6.4 %

- Pending Sales: 3,083 in June 2019 vs 3,059 last June: 0.8%

- New Listings: 4,281 in June 2019 vs 4,515 last June: -5.2%

- Average Sales Price: $472,700 in June 2019 vs $472,400 last June: 0.1%

- Total Market Time: 42 days in June 2019 vs 37 days last June: 14.5%

- Inventory in Months: 2.4 months in June 2019 vs 2.1 months last June

Inventory by Area:

- NW Washington County 2.31 months

- Beaverton/Aloha 1.58 months

- Hillsboro/Forest Grove 2.42 months

Friday, July 12, 2019

Is Mortgage debt Out of Control?

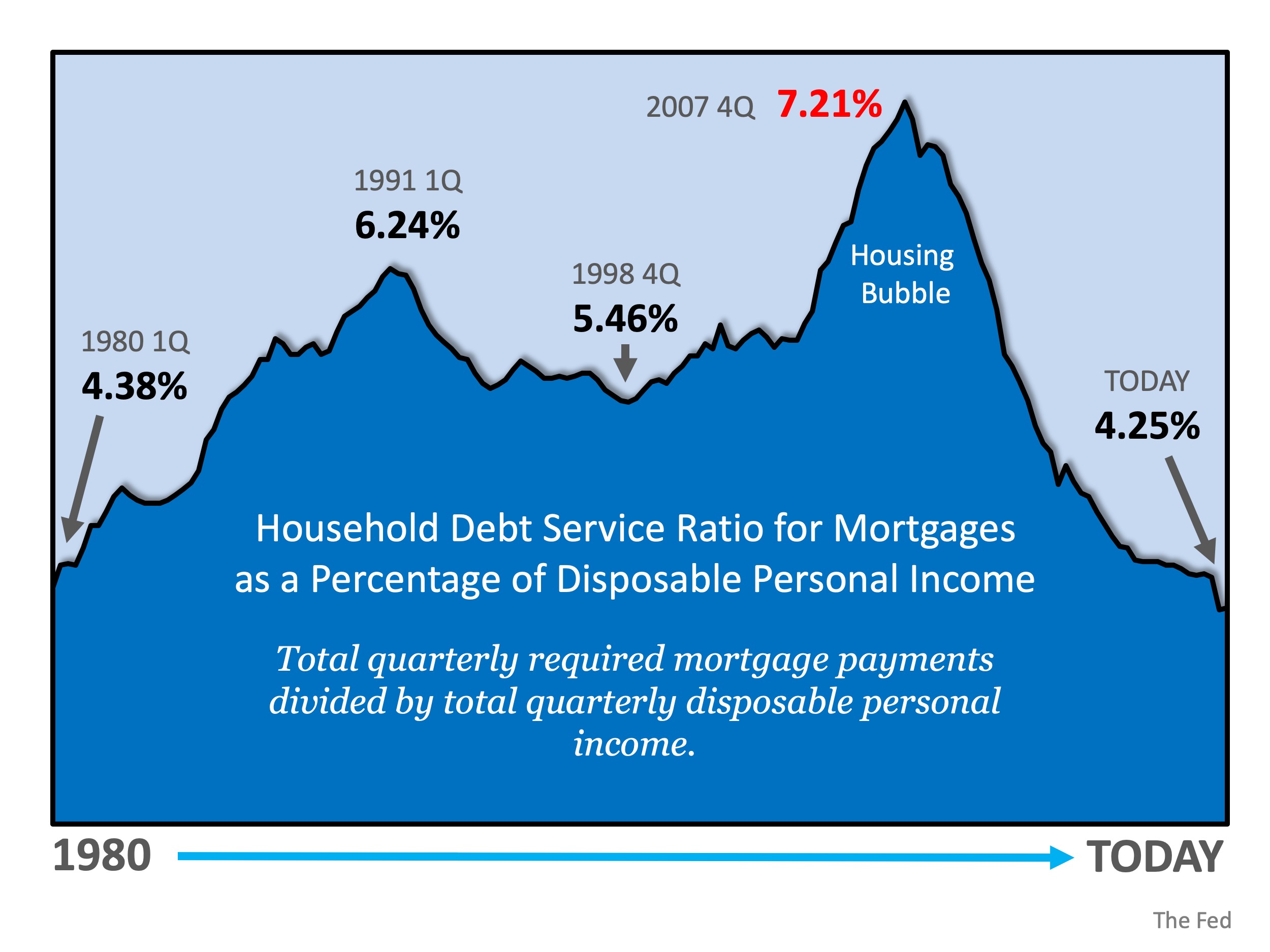

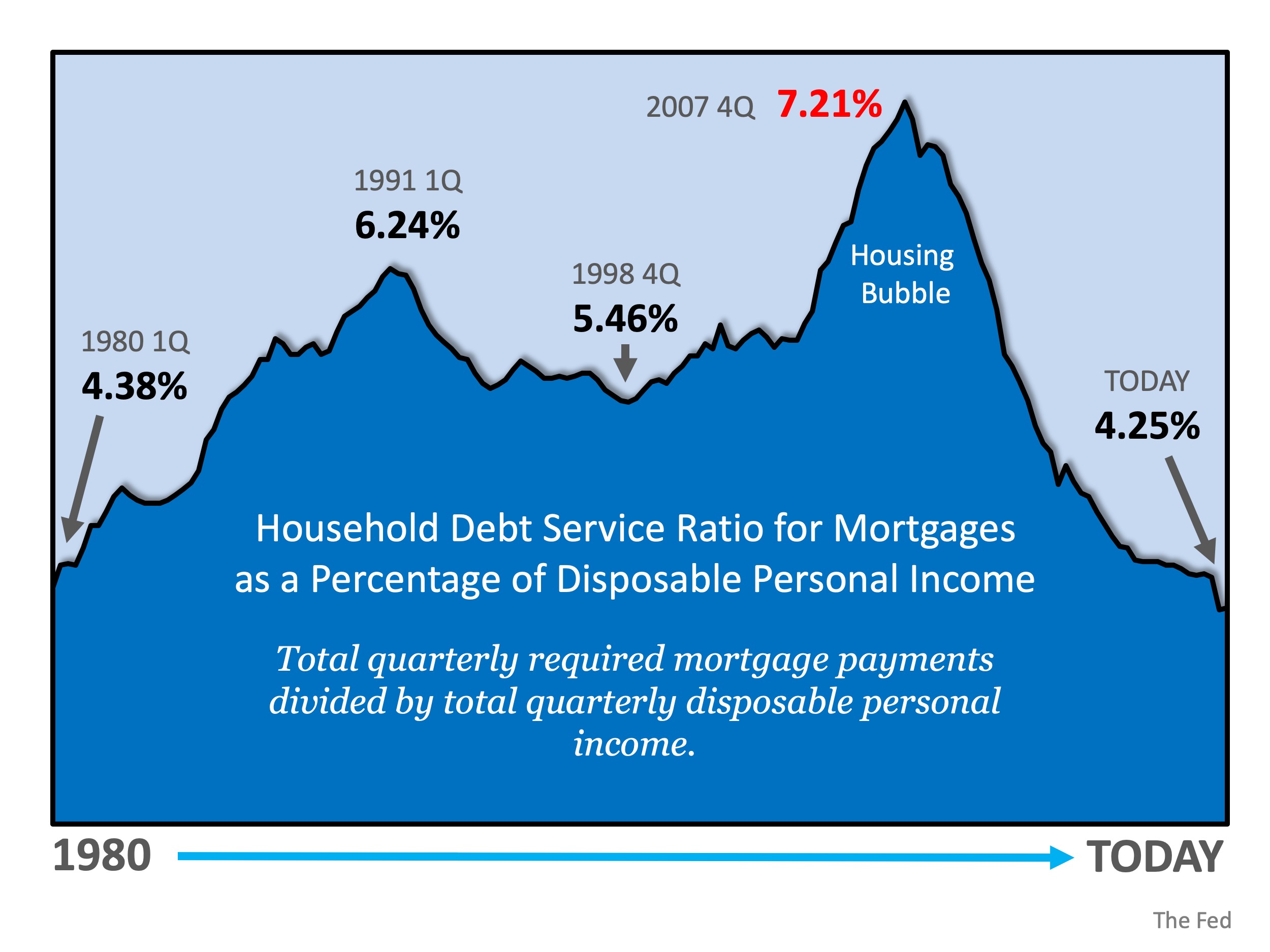

The housing crisis of the last decade was partially caused by unhealthy levels of mortgage debt. Homeowners were using their homes as ATMs by refinancing and swapping their equity for cash.

When prices started to fall, many homeowners found themselves in a negative equity situation (where their mortgage was higher than the value of their home). As a result, they walked away. This caused prices to fall even further.

Headlines are again talking about record levels of mortgage debt, making the comparison to the challenges that preceded the housing crash. However, cumulative debt is not an important data point. If we look at the debt as a percentage of disposable personal income, we are at an all-time low.

Here’s a visual representation of mortgage debt as a percent of income: Furthermore, according to a new report from ATTOM Data Solutions, more than 1-in-4 homes with a mortgage have at least 50% equity. The report explains:

Furthermore, according to a new report from ATTOM Data Solutions, more than 1-in-4 homes with a mortgage have at least 50% equity. The report explains:

“[O]ver 14.5 million U.S. properties were equity rich — where the combined estimated amount of loans secured by the property was 50 percent or less of the property’s estimated market value  Furthermore, according to a new report from ATTOM Data Solutions, more than 1-in-4 homes with a mortgage have at least 50% equity. The report explains:

Furthermore, according to a new report from ATTOM Data Solutions, more than 1-in-4 homes with a mortgage have at least 50% equity. The report explains:— up by more than 834,000 from a year ago to a new high as far back as data is available, Q4 2013.”

Bottom Line

Unlike 2008, homeowners have a comfortable level of mortgage debt and are sitting on massive amounts of home equity. They will not be walking away from their homes if the housing market begins to soften.

Wednesday, July 10, 2019

Just Listed!

New to the Market!

280 NW Pacific Grove Drive

Beaverton, OR 97006

Wonderful home in Stonegate at Waterhouse neighborhood.

3718 sq ft on 2 levels, 4 bedrooms, 3 full baths

Primarily main level living with master bedroom, additional bedroom, formal living and dining rooms, kitchen and eat nook, den/office and laundry room on the main level.

Downstairs offers a huge bonus room with kitchenette and two additional bedrooms.

Tons of storage on lower level

Potential for separate living quarters; perfect for multi-generational living.

For more information visit: 280 NW Pacific Grove Drive

What Buyers Want

If

you’re thinking about putting in a wine cellar or installing an elevator in

your house, you may want to reconsider.

But if

Energy Star windows or a laundry room are on your to-do list, go ahead and put

them in.

That’s

according to findings from the National Association of Homebuilders’ What

Home Buyers Really Want, a publication that looks at what tops home

buyers’ most (http://bit.ly/2Ht6apo) and least wanted lists.

The

survey asked recent and prospective buyers about home and community features

and asked them to rank features as essential/must have, desirable, indifferent,

and do not want.

Energy

Star-rated windows, Energy Star-rated appliances, and the Energy Star rating

for the whole home came in in first, second and third place, respectively, on

respondents’ Top Most Wanted Green Features (http://bit.ly/2QfHjrH). Also

on that list are efficient lighting, triple-pane insulating glass windows,

insulation higher than required by code, and water-conserving toilets.

Adapted from SRES June Newsletter

Friday, July 5, 2019

July 2019 Homework Series

If you need help finding professionals who can assist you with this checklist, I can provide you with a list of preferred contractors and vendors! Just give me a call at 503-956-3505.

Subscribe to:

Posts (Atom)