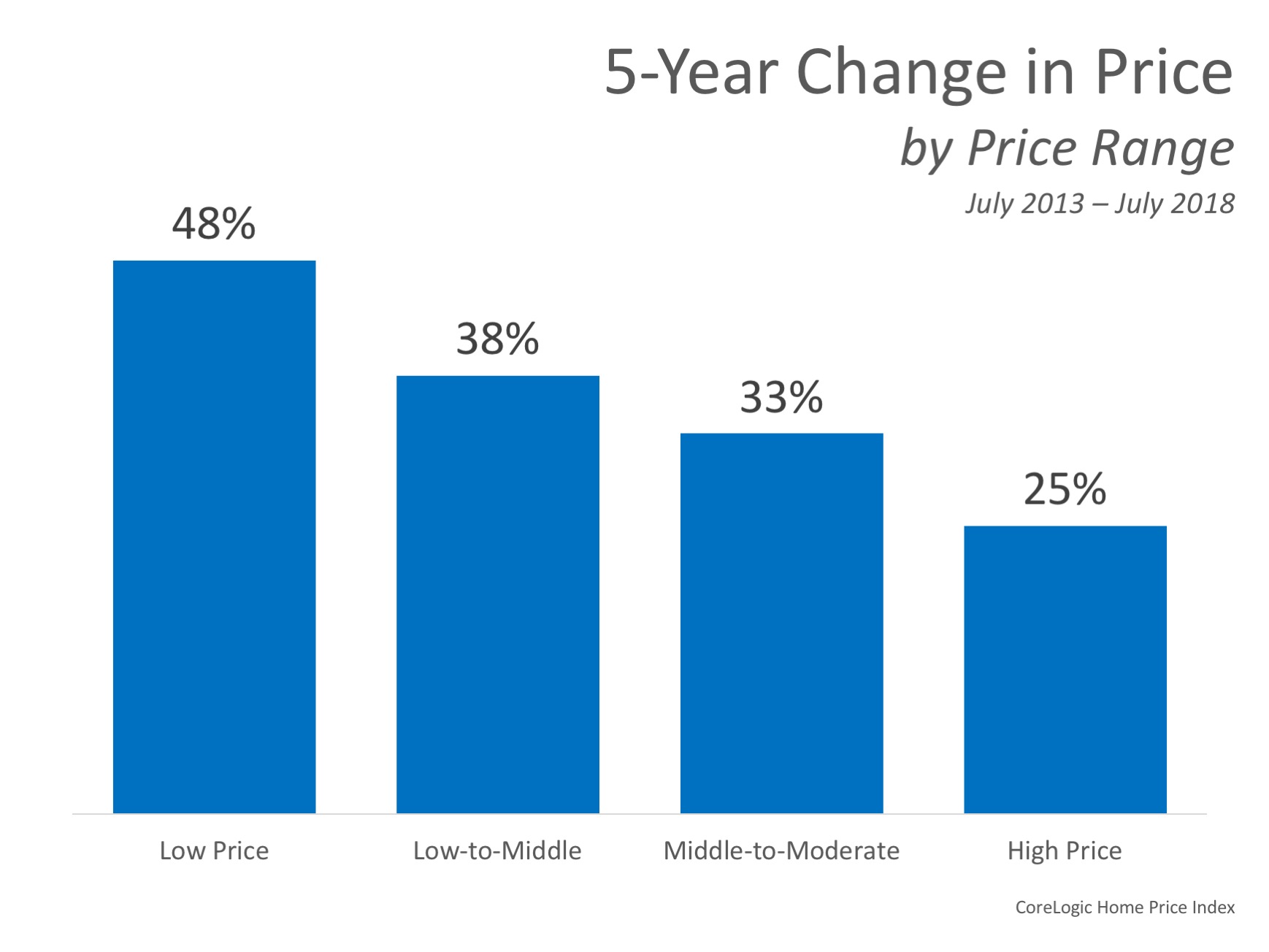

Fall is here - summer vacations are now memories, children are back in school, and the pumpkins are ripening for us to enjoy this upcoming holiday season! In the Real Estate market, the Fall selling season is typically the second busiest season for housing sales over the course of the year. This Fall, we're seeing a bit of a shift in the Portland Metro area housing market. Inventory is hovering around 2 - 2.5 months inventory which is still very low (in a normal market we'd see around 6 months inventory.) This means prices should continue to appreciate at above normal levels, which many experts believe will continue into 2019.

However, two things are occurring that indicate a movement toward a more normal market.

- Listing supply is increasing - marginally so far, but we have moved from less than one month of inventory in some communities to over 2 months as more existing homes and new construction hoems are becoming available. Plus, building permits are also increasing, as we're experiencing in the South Hillsboro, Cooper Mountain, Cornelius and Forest Grove areas.

- Buyer Demand is Softening - a recent Real Estate Broker Survey, and anecdotal input from local Realtors, suggests that buyers have grown more discerning and a level of 'pause' has taken hold in many of our surrounding cities.

What this means is that prices won't appreciate at the levels we've seen recently, nor will they depreciate. Buyers will have more time to consider homes and possibly have the opportunity to view homes of interest a second tiem before making any decision. More contingent offers will be accepted. Seller will more easily be abel to move-up or move-down to a home that better suits their current lifestyles.

Returning to a normal market is a good thing. Even thought it may feel strange after the whirlwind activity we've been experiencing since about 2013. The housing market is not falling apart - we are just returning to a market that will be much healthier in the long run.