Just a few fun suggestions to consider adding

to your holiday traditions!

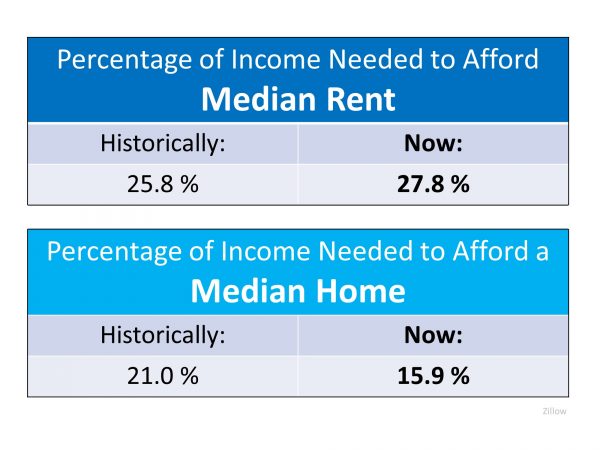

“Cost-burdened renters now outnumber cost-burdened homeowners by more than 3.0 million. In addition, renters make up 10.8 million of the 18.2 million severely burdened households that pay more than half their incomes for housing.”

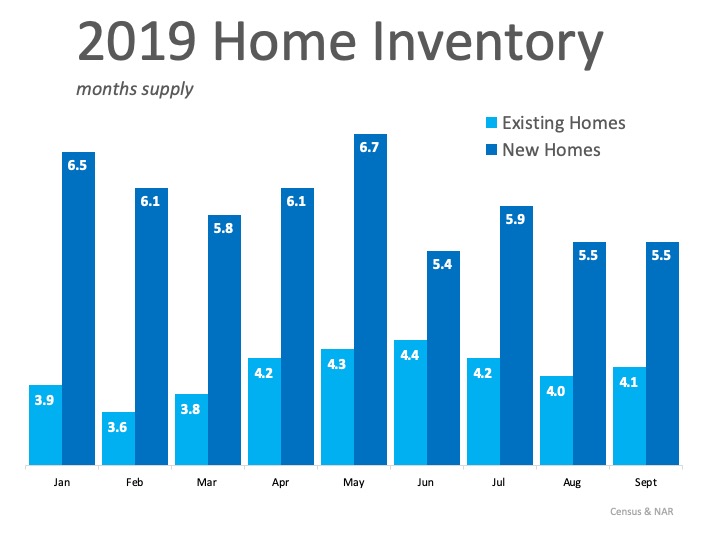

With inventory being one of the biggest housing market challenges today, finding a starter home right now isn’t easy. According to the Q3 Housing Trends Report from the National Association of Homebuilders (NAHB), 68% of those searching for a home think their search will get harder or stay about the same over the next 12 months.

With inventory being one of the biggest housing market challenges today, finding a starter home right now isn’t easy. According to the Q3 Housing Trends Report from the National Association of Homebuilders (NAHB), 68% of those searching for a home think their search will get harder or stay about the same over the next 12 months.“In Qtr3’19, buyers actively engaged in the process of buying a home are more likely to have spent at least 3 months searching (58%) than a year earlier (55%).”

“If still unable to find a home in the next few months, the next step for most long-time searchers is to continue looking for the ‘right’ home in the same preferred location (52%). The next step for 35% is to expand their search area and for 16% is to accept a smaller/older home. Only 15% will give up looking.”

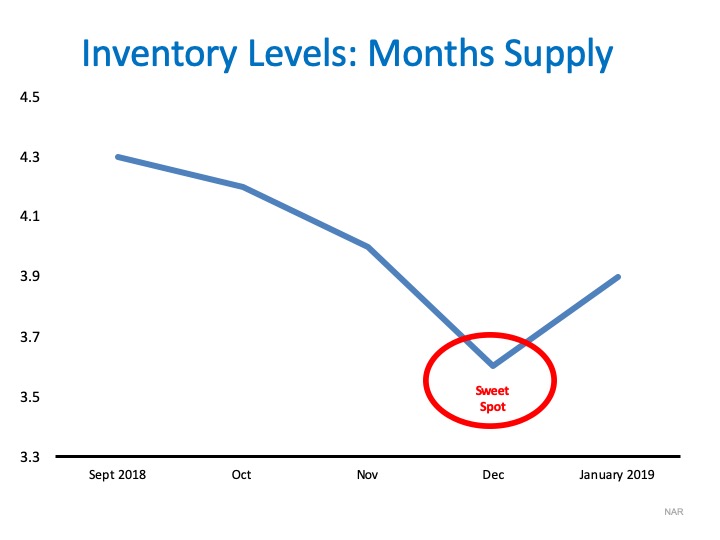

As you can see, the ‘sweet spot’ to list your house for the most exposure naturally occurs in the late fall and winter months (November – January).

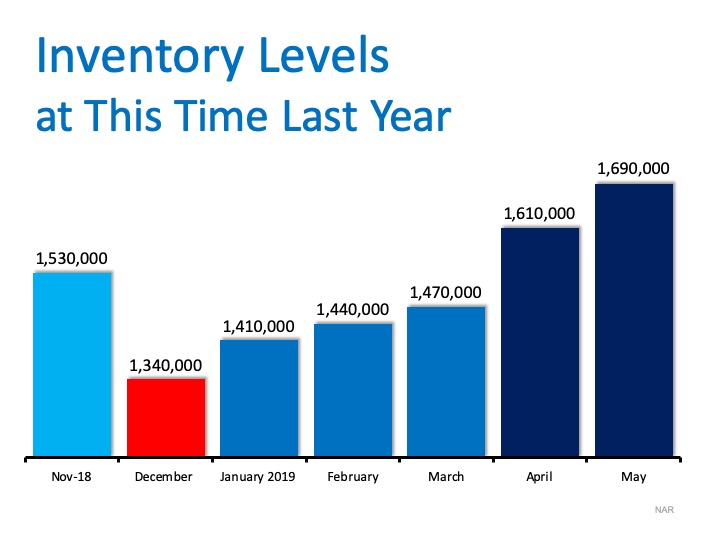

As you can see, the ‘sweet spot’ to list your house for the most exposure naturally occurs in the late fall and winter months (November – January).  In 2018, listings increased from December to May. Don’t wait for these listings and the competition that comes with them to come to the market before you decide to list your house.

In 2018, listings increased from December to May. Don’t wait for these listings and the competition that comes with them to come to the market before you decide to list your house.![Buying a home can be SCARY…Until you know the FACTS [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/10/22080625/20191025-MEM-1046x667.jpg)

How to Choose a

Voice-Activated Assistant

|

|

Smart home technology is becoming more accessible and more helpful than ever before. With the right technology in place, you can control anything from your slow cooker to your home security system via smartphone. To get started, you need to choose a voice activated home assistant. Each home assistant has its own pros and cons, so figure out what’s most important to you. For example, Apple’s Siri is designed with privacy in mind. The data on your Siri devices will always be encrypted. That’s great, but it means that fewer smart home devices will be compatible with Siri. Amazon’s Alexa is easy to set up and compatible with most smart home devices, but there are some issues with voice activation and may pose more of a privacy risk compared to other voice activated assistants. Google’s assistant is probably the cheapest name brand option in the voice-activated assistant market, but it has fewer compatible accessories than other big brand options. There are also dozens of smaller brands available that are even more affordable than Google’s assistant. Creating a smart home is great, but finding the perfect home is priceless. If you or someone you know is thinking about making a move, I’m here to help! |

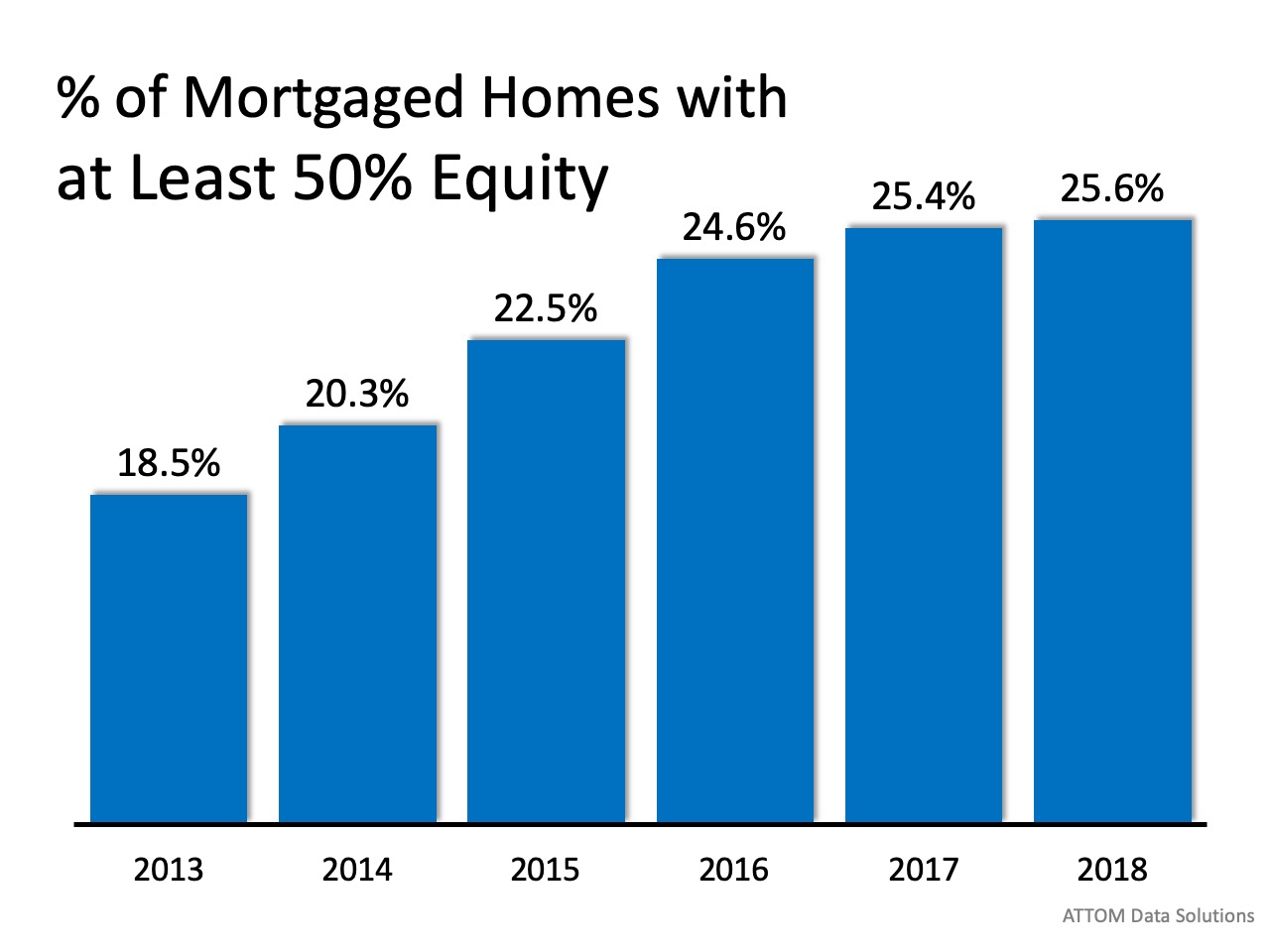

By doing a little math, we can see that 53.2% of all homes in this country have at least 50% equity right now. Of all homes, 37.1% are mortgage-free and an additional 16.1% with a mortgage have at least 50% equity.

By doing a little math, we can see that 53.2% of all homes in this country have at least 50% equity right now. Of all homes, 37.1% are mortgage-free and an additional 16.1% with a mortgage have at least 50% equity.

“When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.”

HOA/Maintenance Dues

Most condos will have a HomeOwners Association (HOA) that is responsible for replacing the roof, addressing siding issues, maintaining landscaping and even some will replace broken windows. However, these services come at a cost to the condo owner. Typically, a monthly, quarterly or annual fee will be charged each condo owner to cover these expenses along with any upkeep for amenities the association is responsible for maintaining such as a pool or tennis courts.

Some condo HOA dues also cover all or some of the utilities. Many times, the water, sewer and garbage services for the units are paid by the condo association. Some will even cover electricity and internet service. When Buyers look at the regular HOA dues, be sure there is a good understanding of what all is included.

Special Assessments

Special assessments are additional dues that are charged to cover expenses that aren’t considered routine maintenance or that are beyond what the standard dues can cover. These unexpected expenses are divided among the condo owners to cover unplanned expenses such as storm damage, new amenities, or projects to protect the health and safety of residents. When purchasing a condo, be aware of the current condition of the building itself, the amenities offered in the development and any future amenities that are planned for the community, to help determine if special assessments may be coming.

Many Buyers considering purchasing a condo will include the ability to have a condo document review by an attorney as a contingency in the sale agreement. There are law firms that specialize in working with condominium developments that will review the budget, reserve account and HOA documents and provide an assessment of the strength of the HOA in covering current expenses, future needs for improvements and unexpected repairs.

Additional Insurance

The condo’s HOA should provide insurance to cover the exterior of the building and any common areas in the condo community. Homeowners are responsible for insuring the interior of their unit, any personal content inside the condo and liability. We often hear the phrase ‘the owner is responsible from studs in, the HOA is responsible for the exterior’. Sometimes this can be a little unclear such as if pipes break between the walls or there is mold in the attic. Get clarification on who covers what areas of the home to ensure you have the proper insurance.

On-going Fees

Many homeowners feel great when they can pay off their mortgage and reduce the monthly costs associated with living in their home. One thing about living in a condo is that you continue to pay the HOA fees long after you’ve paid off the condo itself.

Additional One-time Fees

In more and more condominium developments, the HOA not only charges the regular dues but there may also be membership fees, a share of the realty tax on the land where your condo is built, move-in and move-out fees, transfer of ownership fees and sometimes parking fees if the parking space(s) are not deeded to your unit. Ensure you ask about any additional fees which would generally be payable at the time of closing on the purchase.

Fall season is upon us and outside temperatures are getting cooler. If you haven't already turned on your furnace, you will be soon and will be using your furnance more regularly over the next several months. Here are some maintenance tips to ensure it runs effectively during the cold weather seasons.

Problem: There is no heat at all. • Check for blown fuses or a tripped circuit breaker. • Replace the drive belt. Problem: Soot collects in your house. • Replace the filter. • Call a qualified professional to clean the heating system. Problem: The blower makes unusual noises when the burner is off. • Tighten the setscrews. • Replace the blower mounts. • Check if the belt is worn; replace if needed. • Loosen the belt tension. • Call a qualified professional. Problem: Your rooms are not warm enough. • Replace the filter. • Clean the registers and remove any obstructions blocking the register. • Seal any leaking ducts with duct tape.

Courtesy of American Home Shield

|

“In a nutshell, an HOA helps ensure that your community looks its best and functions smoothly…The number of Americans living in homes with HOAs is on the rise, growing from a mere 1% in 1970 to 25% today, according to the Foundation for Community Association Research.”

“Simply put, CC&Rs are just the rules you'll have to follow if you live in that community. Unlike zoning regulations, which are government-imposed requirements on how land can be used, restrictive covenants are established by HOAs to maintain the attractiveness and value of the property.”

“After your offer to buy a home is accepted, you are legally entitled to receive and review the community's CC&Rs over a certain number of days (typically between three and 10)…If you spot anything in the restrictive covenants you absolutely can't live with, you can bring it up with the HOA board or just back out of your contract completely (and keep your deposit).”

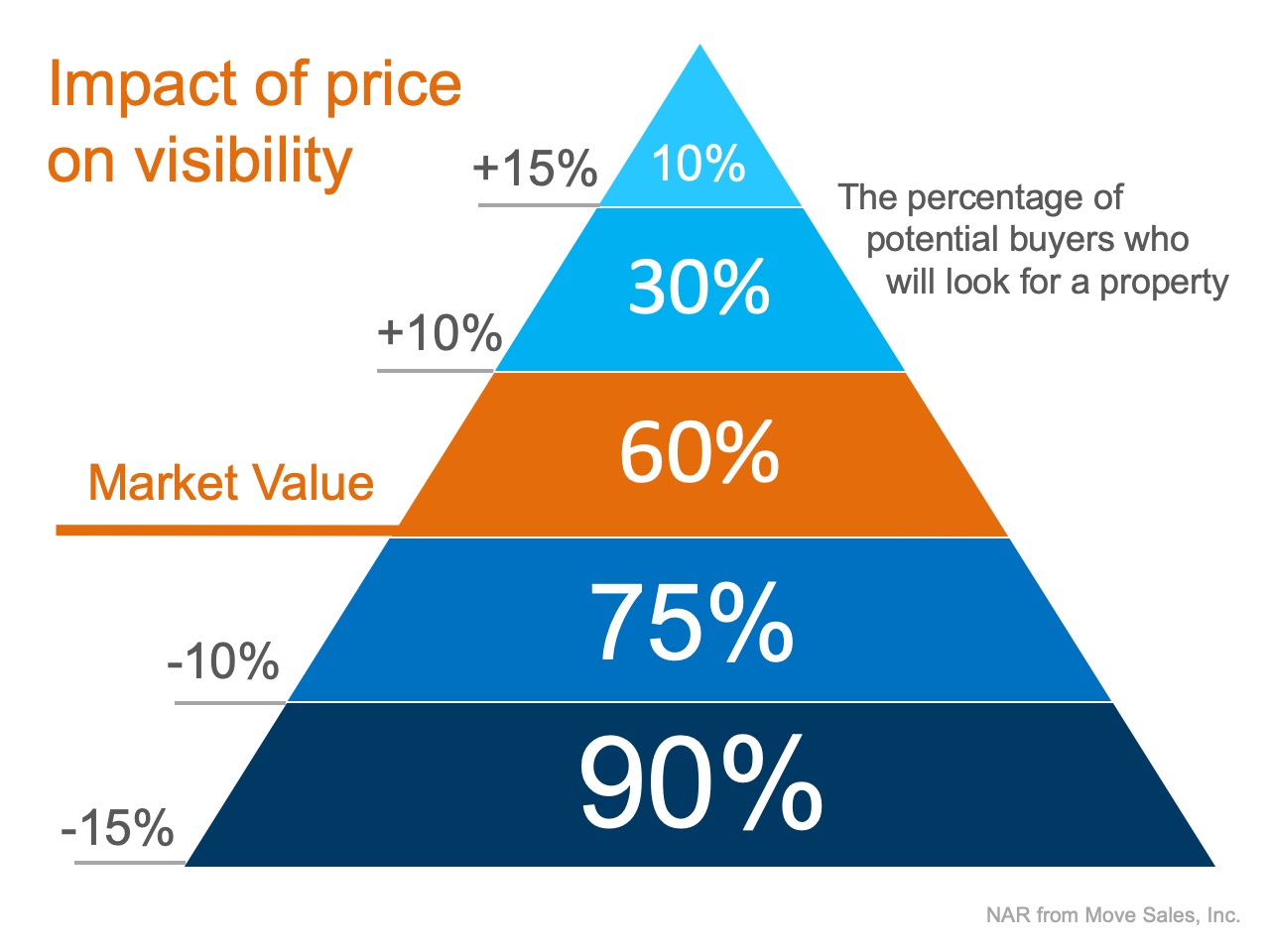

Instead of the seller trying to ‘win’ the negotiation with one buyer, they should price their house so demand for the home is maximized. By doing so, the seller will not be negotiating with a buyer over the price, but will instead have multiple buyers competing with each other over the house.

Instead of the seller trying to ‘win’ the negotiation with one buyer, they should price their house so demand for the home is maximized. By doing so, the seller will not be negotiating with a buyer over the price, but will instead have multiple buyers competing with each other over the house.